Jon Thiele

Gender and economic development

Enterprise development and agribusiness

Credit in economic development

International Development

We all act within systems of these institutions, and understanding this can be useful in analyzing and understanding the problems of developing countries where modernization of economic institutions is usually a prerequisite for broad and lasting economic development. Institutions which are not conducive to growth lead to high "transaction costs", and Ronald Coase in 1991 and Douglass North in 1993 were awarded Nobel prizes related to this branch of economics.

Economic institutions are the formal legal rules and the informal social norms that govern individual behavior in a society.

They are the laws and regulations and the customs and traditions-- things like trust, the role of women, level of cooperation, views of property, how the courts work, corruption, and so on-- and how these "rules of the game" are enforced.

In applying this to development work, North wrote that "institutions form the incentive structure of a society and so the political and economic institutions are the underlying determinant of economic performance. Time, as it relates to economic and societal change, is the dimension in which the learning process of human beings shapes the way institutions evolve. That is, the beliefs held by individuals, groups, and societies determine their choices, and these beliefs are a consequence of learning through time-- not just the span of an individual's life or of a generation but the learning embodied in individuals, groups, and societies that is cumulative through time and passed on intergenerationally by the culture of a society."

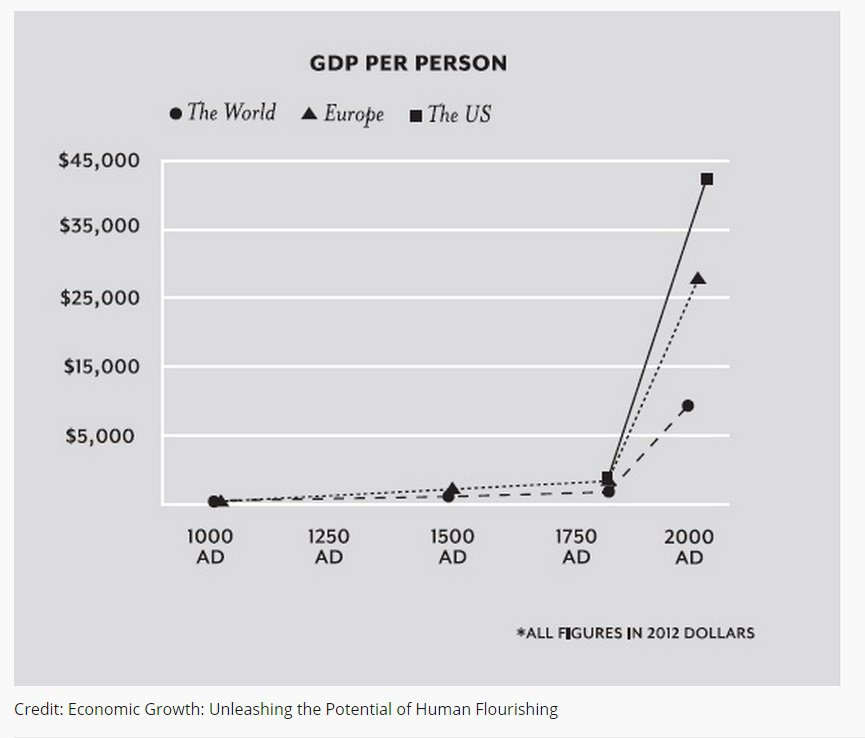

What led to this astonishing improvement? The Scottish Enlightenment led to changes in economic institutions.

An example of the importance of economic institutions and evidence of how they effect society are in this excerpt from a recent essay in Reason magazine:

Markets Make People Nicer

In The Communist Manifesto, Karl Marx thundered that the bourgeoisie and the markets that allow them to prosper "left remaining no other nexus between man and man than naked self-interest, than callous 'cash payment.'" In other words, markets destroy fellow-feeling, turning human beings into cold, cruel calculators. But recent research on how 15 small-scale societies play certain canonical economic games suggests that simply isn't so.

The societies investigated by the economists and anthropologists organized as the MacArthur Foundation's Norms and Preferences Network ranged from hunter-gatherers to slash-and-burn horticulturalists on five continents. To probe these societies' attitudes toward sharing and fairness, the researchers had their members play several games. One of these is called the Ultimatum Game. In it, researchers provisionally allot a divisible pie ($10, say) to one player. This player, the "proposer," offers a portion of the pie to the second subject, the "responder." The responder, who knows both the offer and the total amount of the pie, chooses to either accept or reject the offer. If the responder accepts, he or she gets the amount offered and the proposer gets the remainder. If the responder rejects the offer, neither player receives anything.

Rationally speaking, one might expect that the proposer would offer as little as possible ($1, say) and that the responder would never reject an offer because, after all, one dollar is better than nothing. Yet in hundreds of experiments in nearly two dozen countries, subjects rarely act in that purely self-interested way. In modern societies, the most frequent amount offered by proposers is 50 percent, and responders commonly reject offers under a third. After examining a number of different explanations, most researchers have concluded that those choices are based on the players' sense of what is fair. Since these experiments are usually conducted using western undergraduates, the Preference Network researchers wondered if the results would hold true across societies.

The experimenters offered participants the equivalent of a day or two's wages in their societies. The researchers found that the average offers from proposers ranged from a low of 26 percent to a high of 58 percent and that the most frequent offers ranged from 15 percent to 50 percent. Some groups, such as the Machiguenga and Quichua in South America and the Hadza in Africa, offered around 25 percent of the pie. The most frequent offer from the Machiguenga proposers was 15 percent. Only one Machiguenga responder rejected such a low offer.

Societies like the Machiguenga and Hadza, which deal with few outsiders and are not economically dependent on people other than close kin, turn out to be the stingiest players. The Orma in Africa and the Achuar in South America, who are more integrated into markets, tend to play more like the western undergraduates. "The higher the degree of market integration and the higher the payoffs of cooperation, the greater the level of prosociality found in experimental games," the researchers found.

Herbert Gintis, co-director of the Preference Network team, speculates that markets bring strangers into contact on a regular basis, encouraging people to develop more concern for others beyond their family and immediate neighbors. Instead of parochialism, being integrated into markets encourages a spirit of ecumenism. "Extensive market interactions may accustom individuals to the idea that interactions with strangers may be mutually beneficial," the researchers theorize. "By contrast, those who do not customarily deal with strangers in mutually advantageous ways may be more likely to treat anonymous interactions as hostile, threatening, or occasions for opportunistic pursuit of self-interest."

Markets teach participants the habits of cooperation, trust, and fairness. Based on his research, Gintis argues that history traces humanity's ascent from tribal selfishness to more cosmopolitan liberality. "Market societies give rise to more egalitarianism and movements toward democracy, civil liberties, and civil rights," Gintis argues. "Market societies and democratic societies are practically co-extensive." And they are more generous too.

SOURCES:

The full article by Ronald Bailey, a science correspondent at Reason magazine and author of Liberation Biology (Prometheus).

International Society for New Institutional Economics, www.isnie.org

Encyclopedia Britannica